Last quarter, your facility’s electricity bill jumped 18% despite production remaining stable. Your CFO demanded answers. Your facility manager mentioned something about “kVA charges” and “power factor” but couldn’t explain why you’re suddenly paying $47,000 more per year for the same energy consumption.

You’re not alone. Across Australia, manufacturing, mining, and industrial facilities are discovering a hidden tax on their operations, one that’s been quietly draining profitability for years but has become impossible to ignore as utilities transition to new billing structures.

The culprit? Poor power factor. And it’s costing your business far more than you realise.

What you’re really paying for (and why it matters now)

Here’s what’s changed: Australian utilities have fundamentally restructured how they charge industrial customers. The old model, paying for kilowatt-hours (kWh) consumed plus peak kilowatt (kW) demand, has been replaced by kilovolt-ampere (kVA) demand charges that directly penalise facilities with poor power quality.

Translation for executives: You’re now being charged not just for the productive energy you use, but for the inefficiency of how you use it.

The beer mug analogy every CFO understands

Imagine ordering a beer. You pay for a full pint glass, but it arrives half foam. You’re paying for 568ml but only getting 284ml of actual beer. The foam takes up space, requires the same glass size, and costs the same, but delivers zero value.

That’s exactly what poor power factor does to your electricity bill.

- Real power (kW) is the beer—it does useful work, runs your equipment, powers production

- Reactive power (kVAr) is the foam—necessary for motors and transformers to function, but doesn’t produce output

- Apparent power (kVA) is what utilities bill you for—the full glass, foam and all

When your power factor is poor (say, 0.80 instead of 0.98), you’re paying for 25% foam. And under kVA demand billing, you pay full price for every bit of that foam, every month, forever.

The new reality: kVA demand charges across Australia

Between 2020-2025, every major Australian distribution network transitioned to kVA-based demand tariffs:

New South Wales (Ausgrid, Endeavour, Essential Energy)

- Demand charge: 34.668 cents per kVA per day

- Ratcheting: Your maximum kVA over 12 months determines charges

- Impact: A single power factor excursion during peak demand costs you for an entire year

Real example: A 1,500kW facility at 0.82 power factor draws 1,829kVA. At Ausgrid’s rate, that’s $231,240 annually in demand charges. Improve to 0.98 power factor, and the same facility draws only 1,531kVA – $193,665 annually.

Difference: $37,575 every year.

Queensland (Energex, Ergon Energy)

- Demand charge: $8.90 per kVA per month (Brisbane area)

- Measurement: Peak 30-minute kVA demand

- Impact: Every kVA of unnecessary apparent power costs $106.80 annually

Real example: A Brisbane injection molding facility with 500kW demand was paying for 625kVA at 0.80 power factor: $5,563 monthly demand charges. After improving to 0.99 power factor, they pay for only 505kVA – $4,495 monthly.

Savings: $1,068 per month, $12,816 annually.

This facility’s power factor correction equipment paid for itself in 18 months. They’ll save over $250,000 over the next 20 years by fixing a problem they didn’t know they had.

Victoria, South Australia, Western Australia

Similar kVA-based structures with regional variations in rates and measurement methodology. Regardless of location, the formula remains: poor power factor = higher kVA demand = substantially higher bills.

Beyond demand charges: The complete cost picture

Power factor penalties represent only the visible portion of poor power quality costs. The complete financial impact includes:

1. Energy waste: Paying to transport nothing

Reactive power doesn’t do useful work, but it still flows through your cables, transformers, and switchgear. That current creates heat losses (I²R losses) that you pay for twice: once in energy charges and again in demand charges.

Typical impact: Facilities with 0.80-0.85 power factor waste 12-18% of electrical energy as distribution losses within their own facility. For a facility with $800,000 annual energy costs, that’s $96,000-$144,000 in avoidable waste.

2. Equipment failures: The silent killer

Voltage variations from poor reactive power management are leading causes of premature equipment failure:

Motors: Every 1% voltage deviation from nameplate reduces motor life by approximately 3%. Voltage instability from poor power factor can shorten 20-year motor life to 12-15 years, forcing premature replacement of $80,000-$200,000+ equipment.

Transformers: Voltage and current stress from reactive power and harmonics reduce transformer life by 30-50%. For facilities with $500,000 in transformer assets, this represents $100,000-$150,000 in premature replacement costs over equipment life.

Variable Frequency Drives: DC bus capacitors in VFDs are particularly sensitive. Poor power quality reduces capacitor life from 7-8 years to 3-5 years, creating expensive unexpected failures during production.

3. Production downtime: When seconds cost thousands

Voltage sags—brief voltage dips lasting 0.05 to 0.5 seconds, trip sensitive equipment and halt production. These events stem from poor reactive power management during motor starts, equipment switching, and load changes.

Financial impact calculation:

For a $10M annual revenue manufacturing facility operating 6,000 hours yearly:

- Revenue per hour: $1,667

- Typical voltage sag events: 10-20 annually

- Average downtime per event: 1-3 hours (including restart)

Annual downtime cost: $16,670 to $100,000 from a power quality issue most facilities don’t actively manage.

Mining operations face even steeper costs. A crushing circuit processing 4,000 tonnes per hour of ore worth $35 per tonne generates $140,000 per hour in revenue. A single voltage sag causing 3-hour downtime (clearing material and restarting) costs $420,000.

4. Maintenance burden: Reactive fixes vs. Proactive solutions

If your facility uses traditional capacitor banks for power factor correction (installed 10+ years ago), you’re likely spending $20,000-$40,000 annually on:

- Capacitor replacement every 5-7 years

- Contactor maintenance and replacement

- Emergency repairs during production periods

- Harmonic filter adjustments as loads change

Poor power quality accelerates this maintenance cycle, creating unplanned costs at the worst possible times.

The complete financial picture: A mid-sized facility example

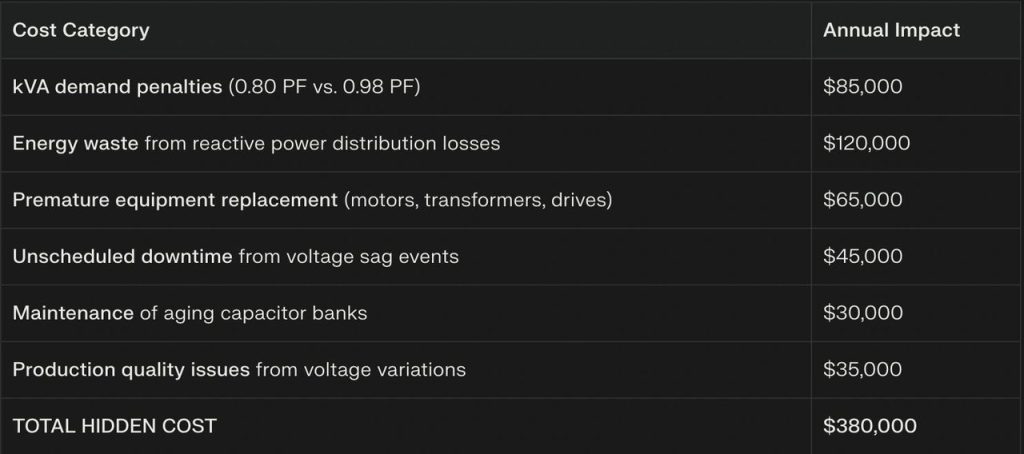

Let’s quantify this for a typical 2MW average demand Australian manufacturing facility:

This represents 20-25% of total electrical costs, a hidden tax that accumulates quarter after quarter, year after year, without appearing as a line item labeled “power quality problem.”

Over 20 years, this facility will pay $7.6 million for poor power quality, enough to fund major production expansions, technology upgrades, or simply flow to the bottom line as additional profit.

Why this crisis is hitting Australian manufacturers now

1. Manufacturing under pressure

Australian manufacturing output declined 2.6% in 2024, with energy costs cited as a primary factor. Since 2022-23, over 1,390 manufacturers have declared insolvency. In this environment, a $100,000-$300,000 annual hidden cost can be the difference between profitability and closure.

2. Utility billing evolution

The transition to kVA demand tariffs makes power factor financially visible in ways it never was before. Facilities that operated for decades with poor power factor suddenly face escalating bills, creating urgent pressure to address an issue previously ignored.

3. Grid instability from coal retirement

AEMO forecasts 90% of coal generation capacity retiring by 2034-35, replaced by variable renewable energy. This transition creates more voltage variations and disturbances, even if your facility hasn’t changed, the grid around you has, making power quality management more critical.

4. Regulatory enforcement increasing

Utilities are enforcing AS/NZS 61000 power quality standards more strictly, with formal non-compliance notices, required corrective actions, and potential disconnection for severe violations. Poor power factor often accompanies harmonic issues, creating compounding compliance pressure.

The critical questions every executive must ask

1. What is our current power factor, and what is it costing us?

Most facility managers don’t actively monitor power factor because it wasn’t financially important under old billing structures. It’s critically important now.

Review your utility bills for kVA demand vs. kW demand. If kVA exceeds kW by more than 10%, you’re paying substantial penalties. A 20% gap represents potentially $50,000-$200,000 in annual avoidable costs depending on facility size.

2. When were our reactive power compensation systems last evaluated?

If your facility has capacitor banks installed 10+ years ago, they’re likely:

- Operating at reduced capacity (capacitor degradation)

- Responding too slowly for modern dynamic loads

- Creating harmonic resonance issues

- Requiring increasing maintenance investment

These legacy systems were designed for electrical loads that no longer represent your facility. Variable frequency drives, modern controls, and equipment changes have fundamentally altered your reactive power requirements.

3. What’s the opportunity cost of delaying action?

Every quarter you continue operating with poor power factor represents another $25,000-$75,000 in avoidable costs (for typical facilities). That’s cash flow that could fund:

- Equipment upgrades improving productivity

- Workforce development and retention

- Research and development for competitive products

- Simply flowing to bottom line as additional profit

Additionally, every quarter of delayed action is time where competitors might be addressing these same issues, gaining cost advantages that compound over time.

What solutions actually work (without getting technical)

Modern power quality solutions, specifically dynamic reactive power compensation using Static VAR Generator (SVG) technology address all these issues simultaneously:

Eliminate kVA demand penalties by maintaining optimal power factor continuously

Reduce energy waste by minimising reactive current in distribution system

Protect equipment through voltage stabilisation and harmonic filtering

Prevent downtime with millisecond-response voltage support during disturbances

Reduce maintenance with solid-state systems replacing mechanical capacitor banks

Typical results:

- 15-30% reduction in total electrical costs

- 12-24 month payback periods across industries

- 20+ year equipment life with minimal maintenance

- $500,000-$3M value creation over equipment lifetime (depending on facility size)

Is poor power factor costing your facility six figures annually?

If the costs outlined in this article sound familiar? Rising kVA demand charges, equipment failures, production disruptions, you’re facing a solvable problem with proven solutions.

Edisonic Energy specialises in helping Australian industrial facilities:

- Understand what power quality issues are actually costing them

- Evaluate modern reactive power compensation solutions

- Calculate facility-specific ROI and payback periods

- Implement proven technology that delivers measurable results

We work exclusively with advanced SVG (Static VAR Generator) technology that’s replaced traditional capacitor banks across mining, manufacturing, steel, and renewable energy sectors, with typical payback periods of 12-24 months and 15-30% electrical cost reductions, creating $500,000-$3M+ in value over equipment life.

Our team of specialists understands Australian energy markets, utility tariff structures, and industry-specific challenges. Contact us to explore whether modern reactive power compensation makes sense for your facility:

SVG Product: https://edisonic.au/svg

Email: info@edisonic.au